georgia ad valorem tax trade in

Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. Under this system owners of all vehicles purchased before March 2013 pay an annual ad valorem tax when renewing their.

Sales Tax On Cars And Vehicles In Georgia

In effect since 2013 and the TAVT replaces the sales tax and the annual ad valorem property tax.

. Timber is taxed at 100 of its fair market value and includes softwood and hardwood pulpwood chip-and-saw logs saw timber poles posts and fuel wood. Exempt from sales and use tax Exempt from annual ad valorem tax birthday tax 1800 title fee 2000 registration fee Subject to a title ad valorem tax TAVT Alternative ad valorem tax FMV of vehicle 65 TAVT. The two changes that apply to most vehicle transactions are.

Likewise a titled owner of a vehicle who trades in their vehicle to a dealer as part of an agreement to. How can I avoid paying the car sales tax in Georgia. Instead the purchased vehicles are subject to the new one-time TAVT.

If you are a new resident then you do not have to. Trade-ins reduce the sales tax that you would pay on a vehicle. The trade-in value of another motor vehicle will be deducted from the value to get the taxable value.

Another dealer said only partially. Georgia Department of Revenue March 1 2013 Titled motor vehicle purchased on or after March 1 2013. It is the fair market value of the property that serves as the foundation for ad valorem taxes which is determined on January 1 of each year.

Dealerships will be required to collect the TAVT on behalf of the customer and. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Ad Valorem Tax Assessment of Timber Sold In Georgia timber is taxed only once during the period of its growth and that is at the time of harvest or sale.

Id hate to get dinged for the higher tax on the new vehicle when renewing the tag right after the vehicle purchase. The TAVT rate will be lowered to 66 of the fair market value. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Can the Trade In Value of the Car be used to Reduce Title Ad Valorem Tax TAVT amount in Georgia. In Georgia the trade-in value of your car will be deducted from the price of your new car.

One salesman told me no because the trade in discount applies to purchases not leases. As an example if you purchase a vehicle for 40000 and your trade-in is worth 10000 then you will only be taxed on the 30000. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to.

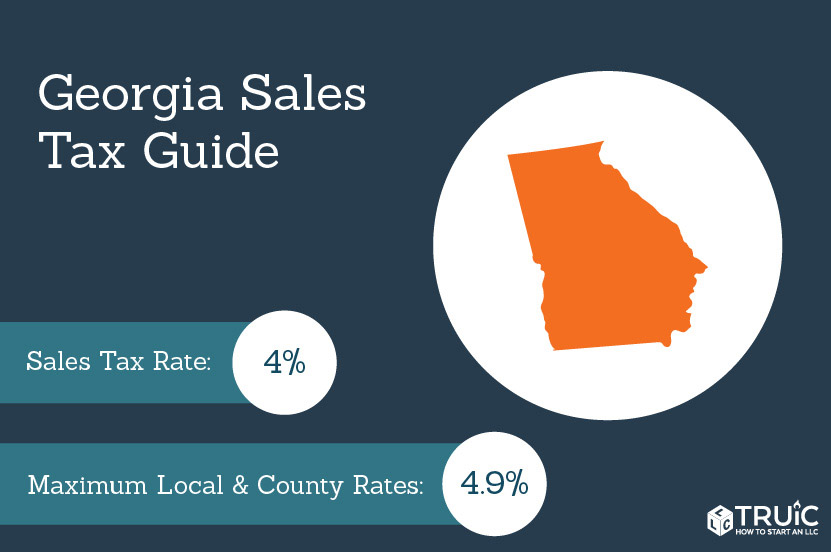

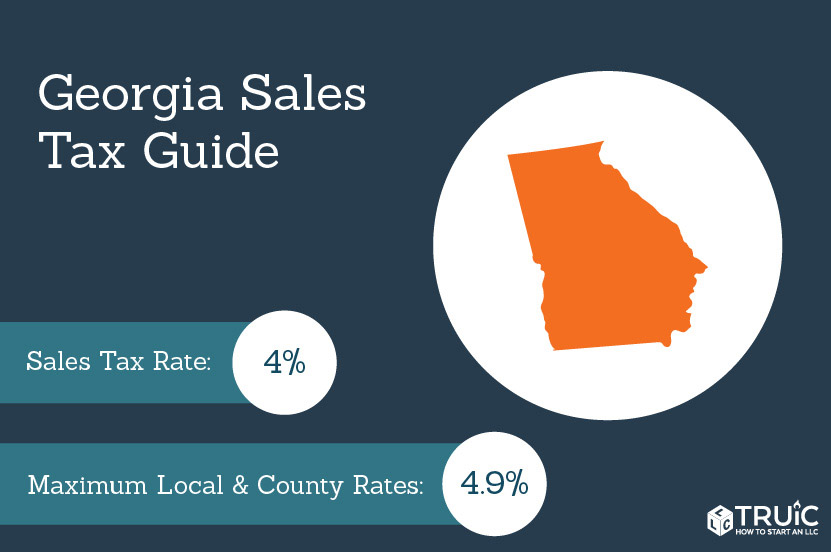

Georgia is exempt from sales and use tax and the annual ad valorem tax also known as the birthday tax These taxes are replaced by a one-time tax called the title ad valorem tax fee TAVT. Sales Tax States shows that the lowest tax rate in Georgia is found in Austell and is 4. The good news is the TAVT will be applied after the trade-in value is deducted.

It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred. Ad valorem taxation sometimes known as property taxation is a significant source of revenue for local governments in the state of Georgia. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT.

Does the title ad valorem tax TAVT apply to all vehicles or just vehicles purchased through new car. Currently the ad valorem tax formula that applies to your vehicle depends on whether you purchased the vehicle before March 1 2013 or after. Cars Purchased On or After March 1 2013.

For instance if you purchase a vehicle for 50000 and your trade-in is valued at 10000 then you are only taxed on the 40000 purchase price. Everyone who owns a vehicle licensed in Georgia must pay ad valorem tax at the time of purchase. TAVT is a one-time tax that is paid at the time the vehicle is titled.

Other possible tax rates in Georgia include. The tax rate is imposed on the fair market value of the car which is typically the purchase price less the value of the trade-in. I was thinking this would be smart avoiding a year of ad-valorem tax but now Im wondering if it would be safer to pay the tax on the old vehicle before making the trade.

Title Ad Valorem Tax TAVT became effective on March 1 2013. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from the sales and use tax and the annual ad valorem tax. This tax is based on the value of the vehicle.

Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. Questions Answers on Georgia Title Ad Valorem Tax TAVT. This calculator can estimate the tax due when you buy a vehicle.

As a general rule Trade-in Value can be used to reduce the Fair Market Value of a motor vehicle for Title Ad Valorem Tax TAVT purposes when exchanged by the titled owner of a motor vehicle who is purchasing another motor vehicle. Under Georgia tax law a purchaser of a motor vehicle must pay a title ad valorem tax TAVT of 7. My trade in would be about 10k 700 credit toward TAVT which would be a nice compromise vs the money I lose selling it.

Buyers must pay this Title Fee on all vehicle sales including private sales and the Title Fee applies to all vehicles. Use Ad Valorem Tax Calculator. The Latin phrase ad valorem can be commonly defined as according to value In the state of Georgia individuals who own a motor vehicle are required to pay a one-time ad valorem tax commonly.

Vehicles purchased through a private sale non-dealer sale that were previously exempt from sales tax are now. Im about to make a trade right before the tag renewal date. Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or birthday tax.

Does a trade-in reduce sales tax in Georgia.

Tavt Tax Calculator Fmv Dealer Guide Georgia Independent Auto Dealer Association

![]()

Georgia New Car Sales Tax Calculator

The Most And Least Favorite Us State Of Each State Mapped Vivid Maps Funny Maps Map North America Map

How To Assess A Real Estate Investment Trust Reit Real Estate Investment Trust Investing Real Estate Investing

International Trade Attorney Jobs In Atlanta Georgia Tax Attorney Jobs In Houston Contract Jobs

Pin By Charles Robert On Your Pinterest Likes Atlanta Neighborhoods The Neighbourhood The Unit

Browse Our Example Of Tax Receipt For Donation Template Receipt Template Receipt Tax Deductions

Georgia Used Car Sales Tax Fees

Georgia Sales Tax Small Business Guide Truic

Updates To Georgia Lease Tax Canton Ga Serving Alpharetta And Atlanta

California Prop 19 Explained Measure Would Change Several Facets Of Property Tax Rules In California Abc7 Los Ange Property Tax Natural Disasters Tax Rules

Infographic Which Countries Are Open For Business Business Regulations Business Infographic

This Chart Shows How Complex The U S Stock Market Has Become Trade Finance Stock Market Us Stock Market

Edward Welbourn And Sons William Thomas Discovered In Baltimore County Families 1659 1759 Baltimore County Family History County

Atlanta Opoly Board Games Games City Games

Loyalist Vs Patriots Homeschool Social Studies Third Grade Social Studies Social Studies Lesson

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes